In the past business year, Bosch was able to further expand its growth areas, advance the transformation of its mobility business, and strengthen the competitiveness of all its business areas. “We’re continuing to invest proactively in technologies that will shape the future – especially technologies related to climate action. However, we’re seeing a delay in the market penetration of such technologies, and momentum from the market has slowed. We need to respond to the weaker order situation and work hard on our competitiveness – that’s the only way we can finance our future growth.” Given these circumstances, Bosch expects there will be a need for adjustment in several areas, such as the Mobility business sector. The latter recently entered into talks on this with employee representatives. Any necessary personnel adjustments should be as socially acceptable as possible. In accordance with the works agreement concluded with employee representatives in summer 2023 for the Mobility locations in Germany, redundancies are off the table until the end of 2027. “Change can succeed only through social partnership. We are also committed to Germany as an industrial location and, in particular, as a manufacturing location,” Hartung said. In addition, Bosch wants to continue hiring in particularly promising business areas and reskill as many associates as possible to move them from shrinking areas to growing ones. By 2030, the company plans to spend around 4 billion euros in total on training and reskilling. This will also require willingness on the part of associates.

Climate policy: instability weakening market momentum

The fight against climate change remains an important concern for technology companies like Bosch and is opening up numerous business opportunities. Bosch recently presented technologies and solutions for sustainable energy use at CES, the U.S.-based consumer electronics show. Hartung believes that current climate policies are destabilizing the business environment for many companies. “When implementation is inconsistent, as we recently saw with Germany’s sudden abolition of electric-car subsidies, problems arise,” he said. “An erratic policy structure impedes long-term purchasing decisions. The economy needs more predictability – in fact, as much as possible.” At the same time, Hartung showed understanding for policymakers: many governments in Western countries are under both austerity pressure and populist criticism, while at the same time having to protect prosperity and mitigate global warming.

Growth strategy: investment to supplement innovation

Even in the current weak economic situation, Bosch is making progress and sticking to its strategic goals: the company aims to be one of the top three suppliers in its key markets and to position itself effectively in all regions of the world. “Even and especially in times of transformation, our broad footprint across industries and regions proves invaluable,” Hartung said. “That does not rule out focused portfolio management, however.” This includes the decision to have the Building Technologies division concentrate on the systems integration business and to sell the majority of its product business. Furthermore, Bosch acquired Climatec in 2015 and Paladin Technologies last year in order to strengthen its position in the North American building automation market.

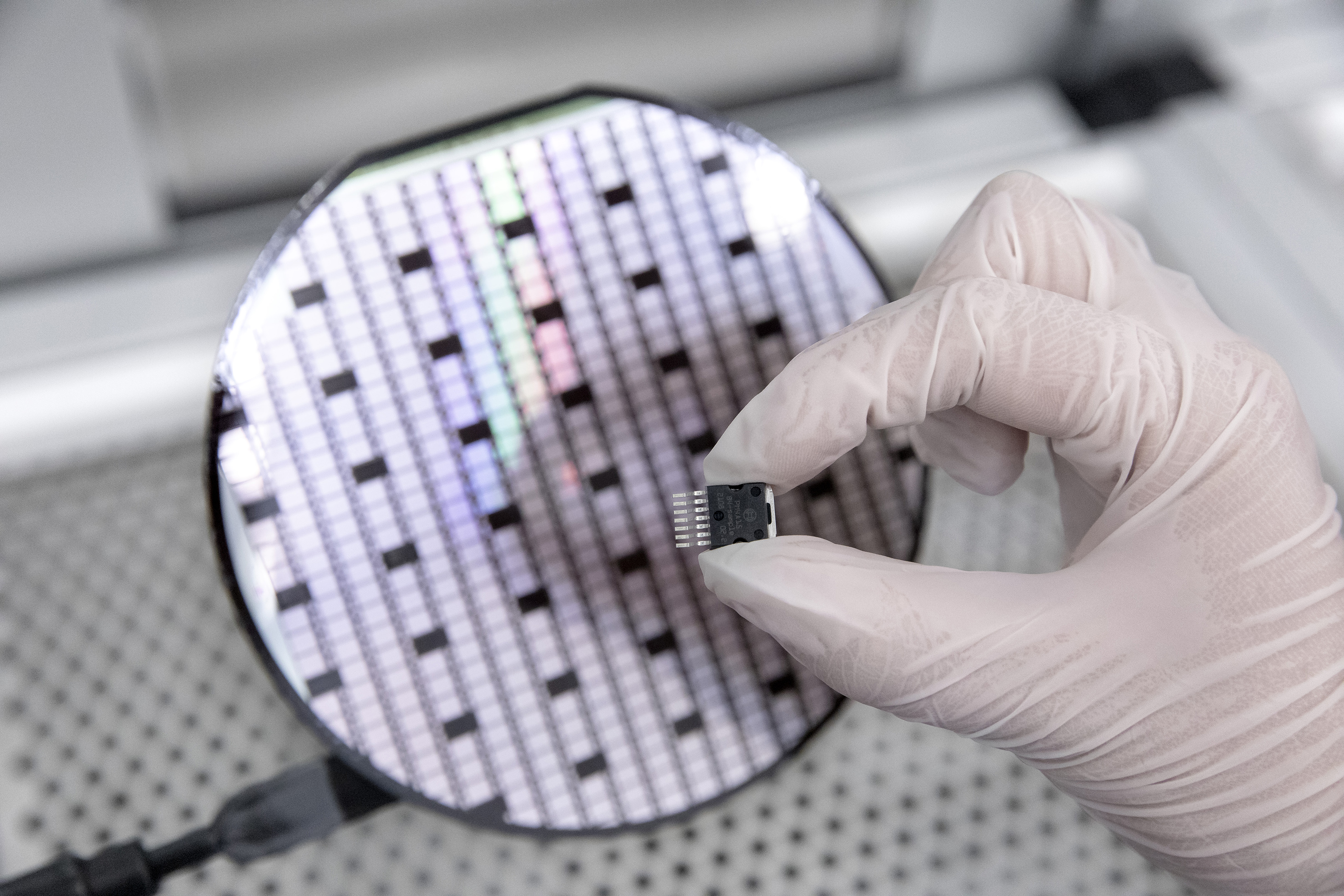

Bosch is also successfully expanding areas of growth it has defined, such as the semiconductor business. With its investment in the ESMC European joint venture and its acquisition of a wafer fab in Roseville, U.S., Bosch made significant investment decisions in 2023. The company is aiming for further growth with the manufacture of silicon-carbide chips, or SiC chips for short. These semiconductors are used in the power electronics of electric cars and can increase driving range. “By building silicon-carbide structures vertically and no longer on a flat plane, we can further increase the power density of the chips. We were the first SiC manufacturer to put this technology on the road, and with the second generation, we were able to increase performance by a further 30 percent in 2023,” Hartung said, pointing to the company’s innovative strength. “At Bosch, investment supplements innovation.” Starting in 2026, Bosch plans to manufacture the first vertically structured SiC chips on cost-effective 200-millimeter wafers.

Transformation in the mobility industry: standardization to promote electromobility

Bosch is responding to the transformation of the automotive industry with the biggest realignment of its core business in the company’s history. The integrated Mobility business sector has been in place since the beginning of 2024. One of its new features is horizontal responsibility for three areas of future importance: software, semiconductors, and vehicle computers. As Bosch moves toward the mobility of the future, it plans to improve how it leverages emerging and established technologies to maximize its business opportunities.

For example, there has been a boost in demand for new redundant braking systems, which support automated and electrified driving in particular. Hartung reports that Bosch is aiming for 10 percent annual growth here up through 2030. “Overall, we are growing twice as fast as the competition with our braking systems. We are also maintaining our sales in ESP, although the market volume here is declining.” With regard to electromobility, Hartung believes there is still much to do, such as remedying the lack of charging stations and affordable electric cars in Europe. “China was able to increase its automobile exports by 60 percent last year, an achievement that should give us pause for thought,” he said. “We know that our Chinese customers prefer standardization in electric powertrain solutions – this yields economies of scale that we in Europe cannot afford to miss out on.”

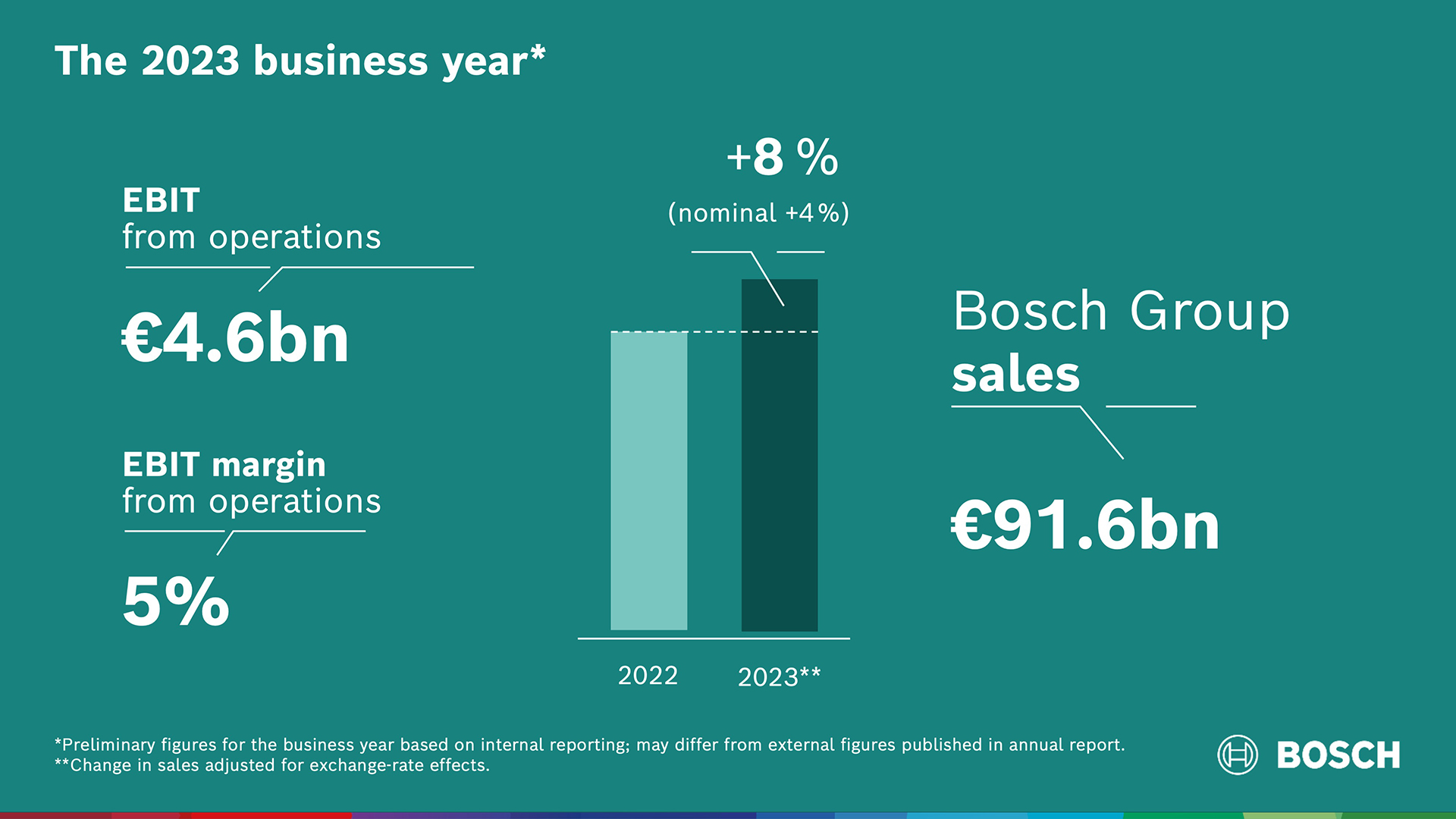

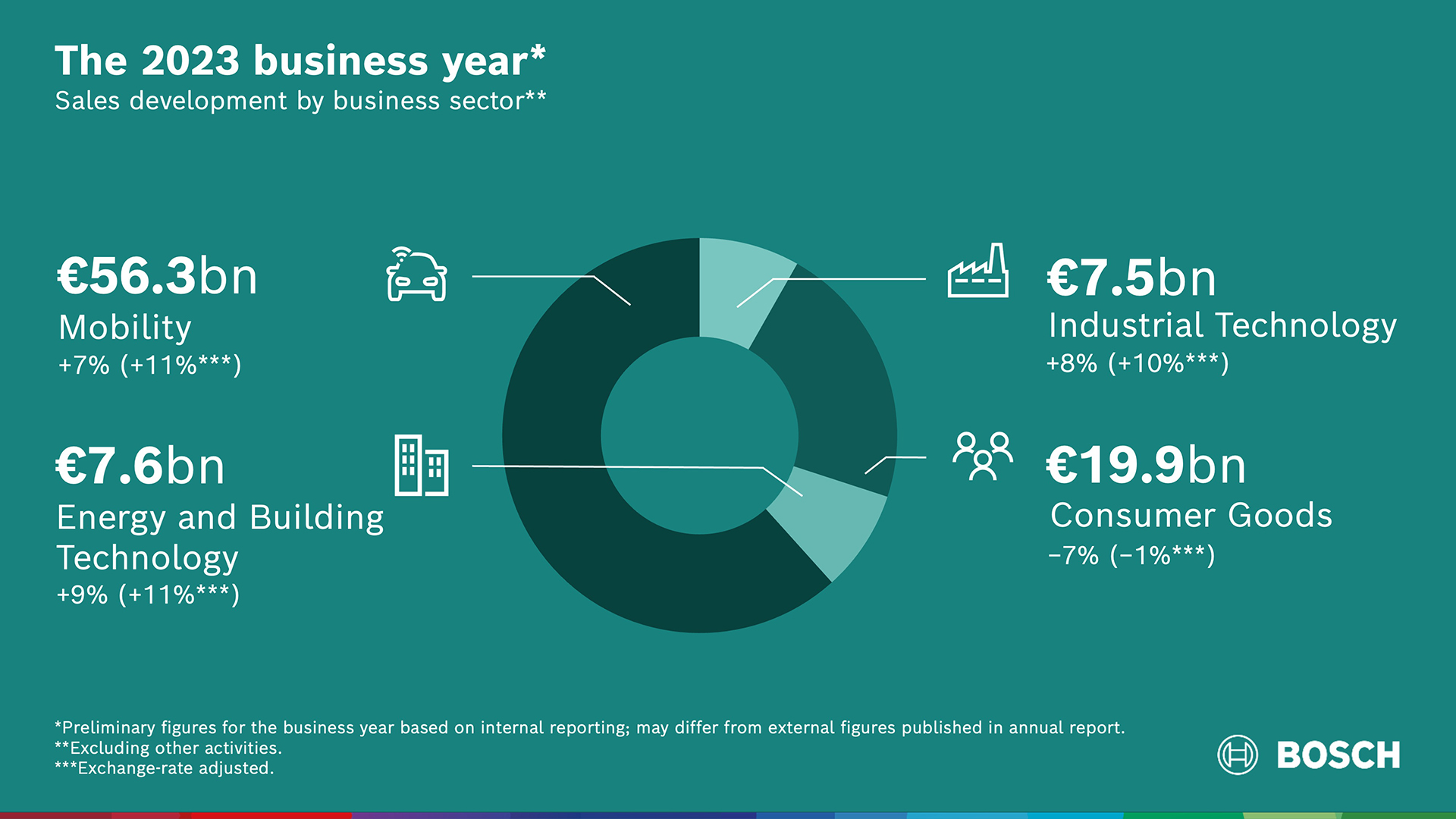

Business developments in 2023: strong growth in Mobility and in Energy and Building Technology

In 2023, sales development in Bosch’s business sectors showed a mixed picture. At 56.3 billion euros in 2023, Mobility remained the Bosch business sector with the strongest sales. It achieved growth of 7 percent, or 11 percent adjusted for exchange-rate effects. “Our products are in demand, both in traditional and new areas of business. This motivates us to continue developing the sector, a task that will still demand a lot from us,” said Dr. Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH. The Industrial Technology business sector achieved sales of 7.5 billion euros. This figure is 8 percent higher than in the previous year due to the acquisition of HydraForce; adjusted for exchange-rate effects, this represents an increase of 10 percent. In the Consumer Goods business sector, sales amounted to 19.9 billion euros. “Marked consumer restraint had a significant impact on our power tools and household appliances businesses,” Forschner said. At 7 percent, sales were down on the previous year; adjusted for exchange-rate effects, this was a slight decline of 1 percent. The Energy and Building Technology business sector saw strong sales growth of 9 percent to 7.6 billion euros. After adjusting for exchange-rate effects, this increase rises to 11 percent. “Here we benefited not only from heavy demand for energy-efficient and renewable heating technology but also from the expansion of our service business in the Bosch Global Service Solutions division,” Forschner said.

Business developments in 2023: strongest growth in Europe and North America

Regional sales development at Bosch presented a mixed picture as well. “Europe and North America posted the strongest nominal growth,” Forschner said. In Europe, sales grew by 6 percent to 46.8 billion euros, an increase of 8 percent after adjusting for exchange-rate effects. Sales in North America rose to 15.2 billion euros – an increase of 4 percent, or 8 percent after adjusting for exchange-rate effects. In South America, sales were 1.7 billion euros, down 6 percent on the previous year. Adjusted for exchange-rate effects, however, growth amounted to 4 percent. “The weak Brazilian real was a decisive factor here,” Forschner explained. Sales in Asia Pacific climbed slightly by 1 percent to 27.9 billion euros, or by 9 percent when adjusted for exchange-rate effects. “These figures reflect the weaker development in several sectors of the Chinese economy,” Forschner said. “Our strong growth in India and Japan was only partially able to offset this.”

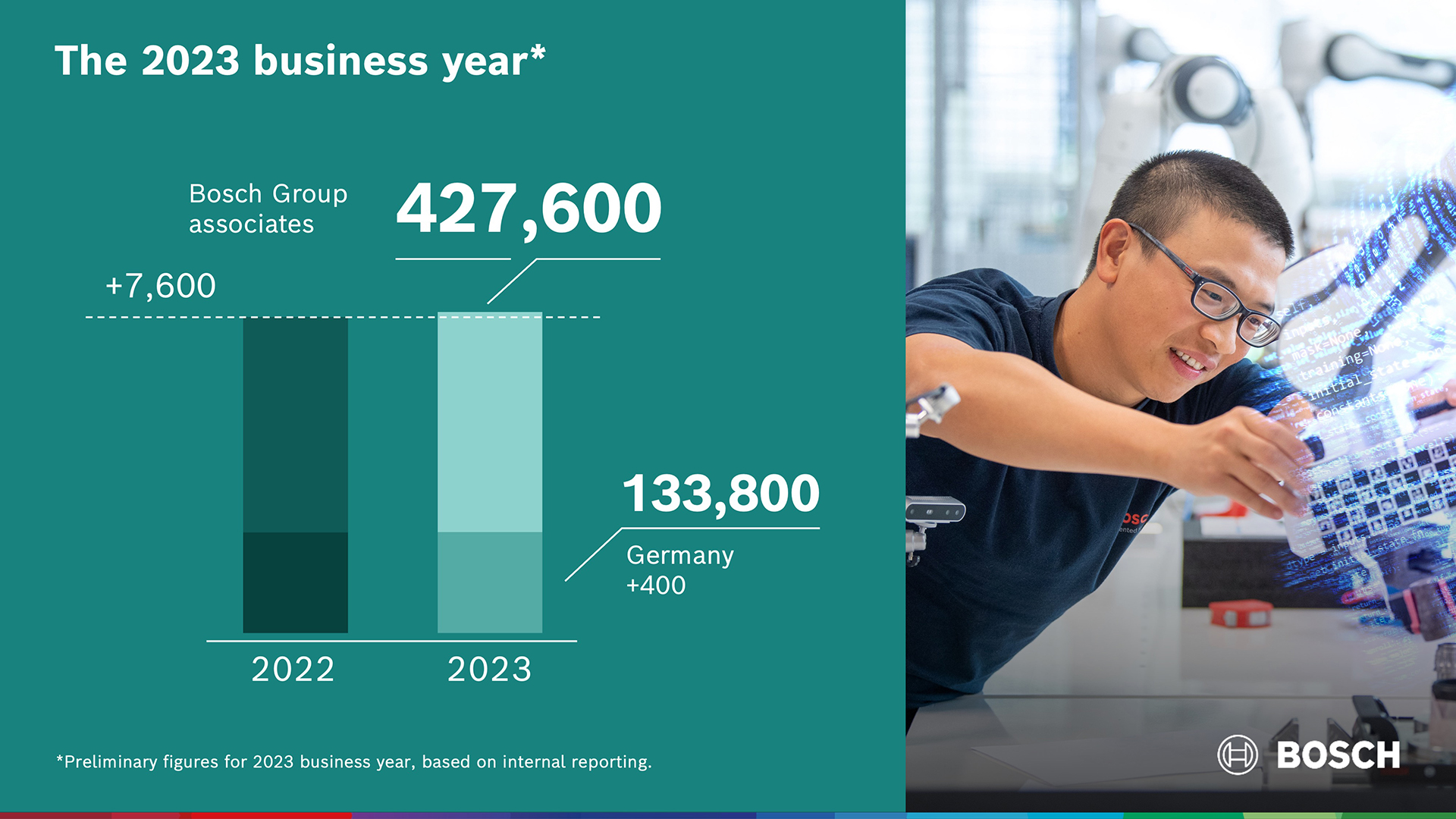

Headcount development in 2023: employment at a stable level

As of December 31, 2023, the Bosch Group employed some 427,600 people worldwide. According to preliminary figures, this is around 7,600 or around 2 percent more than in the previous year. In Germany, the number of associates remained virtually unchanged at 133,800.

Outlook for 2024: weak growth stimulus from the global economy

For the current year, Bosch is still expecting only moderate global economic growth of 2 to 2½ percent. “According to our estimates, the global economy won’t start picking up momentum until 2025,” Forschner said. “The outlook in all our key sectors is gloomy.” In the automotive industry, Bosch expects production levels in 2024 to be similar to those of the previous year. The company predicts the economic downturn in mechanical engineering will continue and doesn’t expect demand for consumer goods to rebound until 2025. In the energy sector, Bosch believes that customers’ willingness to buy remains subdued, particularly in the key German market. The reason for this is the uncertainty among homeowners about future regulations for heating systems. The company is not counting on any support from the markets in the 2024 business year either. “We are keeping a firm eye on our target margin of at least 7 percent, even if we have to make considerable upfront investments in a lukewarm economic environment,” Forschner said. At any rate, Bosch is pushing back its previous timeline for achieving its target margin by one to two years. The company intends to further intensify its efforts to improve costs and competitiveness in order to successfully tap into future markets. Forschner added: “We are striving for a balance between profitability and efficient use of our capital resources on the one hand and the upfront investments for tomorrow’s growth on the other.”

1 Based on internal reporting; may differ from external figures published in annual report.