The corporate strategy is reflected in Bosch’s financial targets as well: with a normal inflation rate of between 2 and 3 percent, Bosch aims to achieve annual growth of between 6 and 8 percent on average until 2030.

In the first quarter of 2025, Bosch was able to increase its year-on-year sales by 4 percent, both in euros and adjusted for exchange-rate effects. The Bosch Group is still aiming for a target margin of 7 percent in 2026. Hartung sees this as an extremely challenging task in view of global upheaval and, above all, significantly stronger competition from Asia: “We will continue to work intensively on our costs and structures and focus on profitable business areas.” Bosch has already announced structural adjustments and job cuts in various areas, with an eye to strengthening the company’s competitiveness. The company is in contact with employee representatives and is urging them to reach an agreement quickly and start the implementation process. “Only then will we be able to take advantage of opportunities in a dynamic market environment, including those that crop up suddenly. We can no longer afford delays, as this would further weaken our competitive position.” Overall, Bosch assumes that the number of jobs in the company will continue to decline, particularly in Germany and Europe.

Innovation boost: investment of 250 million euros in startups

Bosch is relying on its strengths to emerge successfully from the current transformation of markets and technology: “As a global technology leader, we are fully committed to boldly playing to our strengths, such as our high level of innovativeness,” Hartung explained. “This will open up numerous future opportunities for us, even in an adverse environment.” Last year alone, Bosch registered more than 6,700 patents, making it one of the 100 most innovative companies in the world, according to analysts Clarivate. Bosch also sees its collaboration with startups as a major stimulus for growth. As one of Europe’s biggest corporate venture-capital investors, the Bosch Group announced a new fund for venture capital : the subsidiary Bosch Ventures is providing around 250 million euros. “For one thing, investments in startups promote technological progress in business and society, and for another, this collaboration also benefits our divisions,” says the Bosch chairman, explaining the company’s continued high level of commitment to venture capital. “Innovations are also important drivers of a country’s economic growth.”

Sustainability: new CO₂ targets despite global economic turbulence

In terms of politics, Bosch, like the entire industry, is seeing the world order drifting apart. “We are currently experiencing major upheavals in our business environment, while in the global economy free trade is coming under massive pressure,” Hartung said. In light of the new government in Germany, Hartung stressed that new debts do not release anyone from the obligation to make savings wherever possible. “The billion-euro financial packages should be invested specifically in the planned reforms,” he said. The Bosch Group has underlined its conviction that, despite all the global turbulence, climate action must not slip out of sight by announcing new scope 3 targets.

Hartung explained that the aim is to bring down carbon emissions outside Bosch’s direct sphere of influence, such as those from product use, even further by 2030. Irrespective of its growth targets, Bosch wants to double its corresponding CO₂ reduction target by then from 15 to 30 percent compared to 20181. “Climate change won’t disappear just because the global economy currently has other challenges to deal with,” Hartung pointed out. “Sustainability remains a priority for Bosch.”

The 2025 business year: growth opportunities despite uncertainties

Given the volatile developments in global trade, Bosch believes the outlook for the current year is fraught with uncertainty. The consequences of additional tariffs and possible economic effects from European and German infrastructure investments also make an assessment more difficult. For the current year, Bosch is still anticipating modest growth in the global economy of 2¼ to 2¾ percent. “We need to work even harder to keep costs competitive, and we will drive forward our growth strategy through investments, innovations, and acquisitions,” said Markus Forschner , member of the board of management and chief financial officer of Robert Bosch GmbH. “We will continue to expand our successful regionalization strategy. Proximity to customers is and will remain important to us.” This year, Bosch is aiming for organic sales-revenue growth of between 1 and 3 percent despite the fact that the business environment will remain difficult with weak core markets. The EBIT margin from operations is expected to improve significantly compared to 2024, even if earnings are again expected to be impacted by high upfront investments in technologies with future importance and structural adjustments. According to Forschner, if the planned acquisition of parts of the Johnson Controls and Hitachi business is completed by the middle of the year, total sales should even be one to two percentage points higher in 2025. The first full consolidation will then take place in the 2026 business year.

Mobility: innovations in software and hydrogen

In the Mobility business sector, Bosch expects developments in electromobility, hydrogen, and software-defined vehicles to be a major stimulus for growth. “The future of mobility will be determined by software – and we want to remain at the forefront as a partner to automakers,” Hartung said. At the Auto Shanghai trade fair, Bosch recently presented a whole range of innovations , including a modular system for driver assistance in three variants – for the entry-level, mid-range, and premium segments – and a cockpit vehicle computer with AI functions.

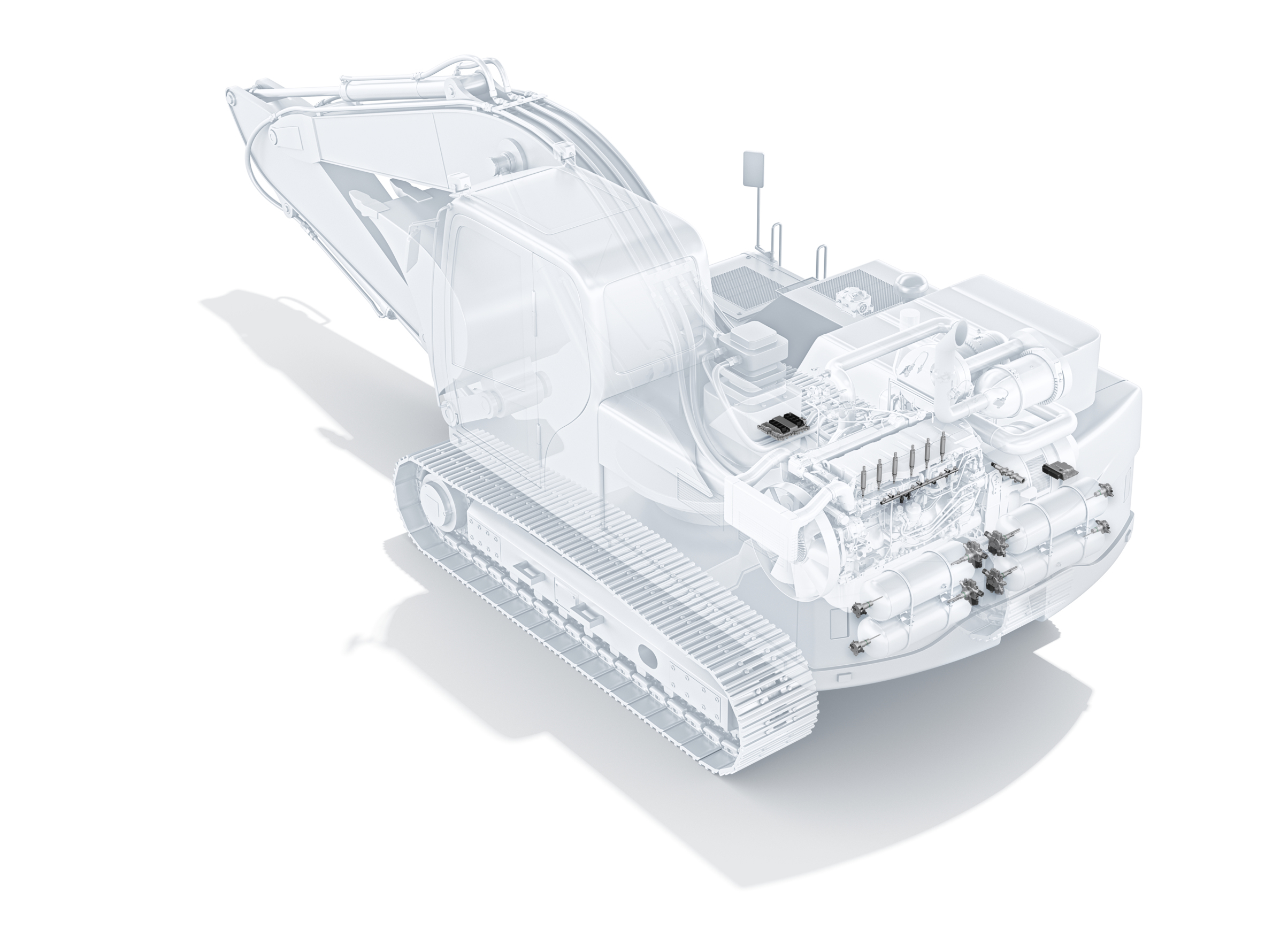

In the field of electromobility, Bosch is going into production this year with a further 50 projects, primarily in Europe and China. “One important technology of the future is the hydrogen engine ,” Hartung said. “This powertrain emits no CO₂ locally and is particularly suitable for heavy off-highway trucks and powerful construction and agricultural machinery.” At Hannover Messe, Bosch premiered Hybrion stacks , which form the heart of electrolysis plants for the production of hydrogen. The company expects to generate billions in sales in this market by 2030.

Consumer Goods: connectivity and batteries for greater convenience

Bosch expects new customer requirements to provide important growth opportunities for its Consumer Goods business, even in a subdued economic climate. In power tools, the focus is on expanding the range of cordless devices. The range for commercial customers such as electricians now also includes cordless hydraulic tools . “Bosch already increased the number of product launches considerably in 2024,” Hartung said. “In the current year, we plan to significantly accelerate the expansion of our power tool range with around 90 new product launches.” Among other things, Bosch is embracing the new Matter connection standard for home appliances: this year, BSH Hausgeräte is launching a fridge-freezer that is the first Matter-capable home appliance on the market. It enables fast, simple, and secure cross-manufacturer connectivity. “To better serve regional demand, we’re currently getting our first home appliance factory on the African continent up and running,” Hartung said. Bosch intends to produce up to 350,000 ovens a year for customers in Africa and the Middle East at the new plant in Egypt.

Industrial Technology: software push for manufacturing

In its Industrial Technology business, Bosch expects order intake to stabilize and is still pursuing the goal of achieving sales revenue of around 1 billion euros with software and software-based services alone by the beginning of the next decade. One step toward this goal is a comprehensive range of digital services such as the Hydraulic Hub, which simplifies and accelerates the servicing and maintenance of industrial hydraulics products, thereby increasing machine availability. “We are also continuing our software push in industrial technology,” Hartung said. “Our customers benefit from the fact that we sell from user to user and incorporate our experience from our own manufacturing.” In addition, factory automation for growth areas such as the production of batteries, semiconductors, and consumer goods is to become a further focus in the future. Bosch Rexroth recently presented numerous innovations for the energy transition at Hannover Messe – for example, for the electrification of industrial and mobile applications.

Energy and Building Technology: expanding the HVAC business

In the Energy and Building Technology sector, Bosch expects the planned acquisition of the heating, ventilation, and air-conditioning (HVAC) business of Johnson Controls and Hitachi to deliver significant growth. “We want to be among the world leaders in heating and air-conditioning technology,” Hartung said in reference to the acquisition, which is expected to be completed by the middle of the year. “We expect strong growth from the acquisition, particularly in North America and India.” Growth will also be driven by new hybrid heat pump systems (all-in-one heating), which Bosch first presented at the ISH industry trade fair. These can be operated as stand-alone gas or oil condensing boilers or combined with an outdoor heat pump unit. They can even be converted to run on electricity only. In building technology, Bosch’s stronger focus on its integrator business is bearing fruit, while earlier acquisitions are strengthening its automation business. A key growth lever in all these fields is the use of AI: for example, the Wildfire Detection solution enables the early detection of forest fires. Smoke gases are detected by gas sensors, which use AI algorithms to report them to the emergency services and provide them with information collected by drone.

The 2024 business year: major investments in the future, positive free cash flow

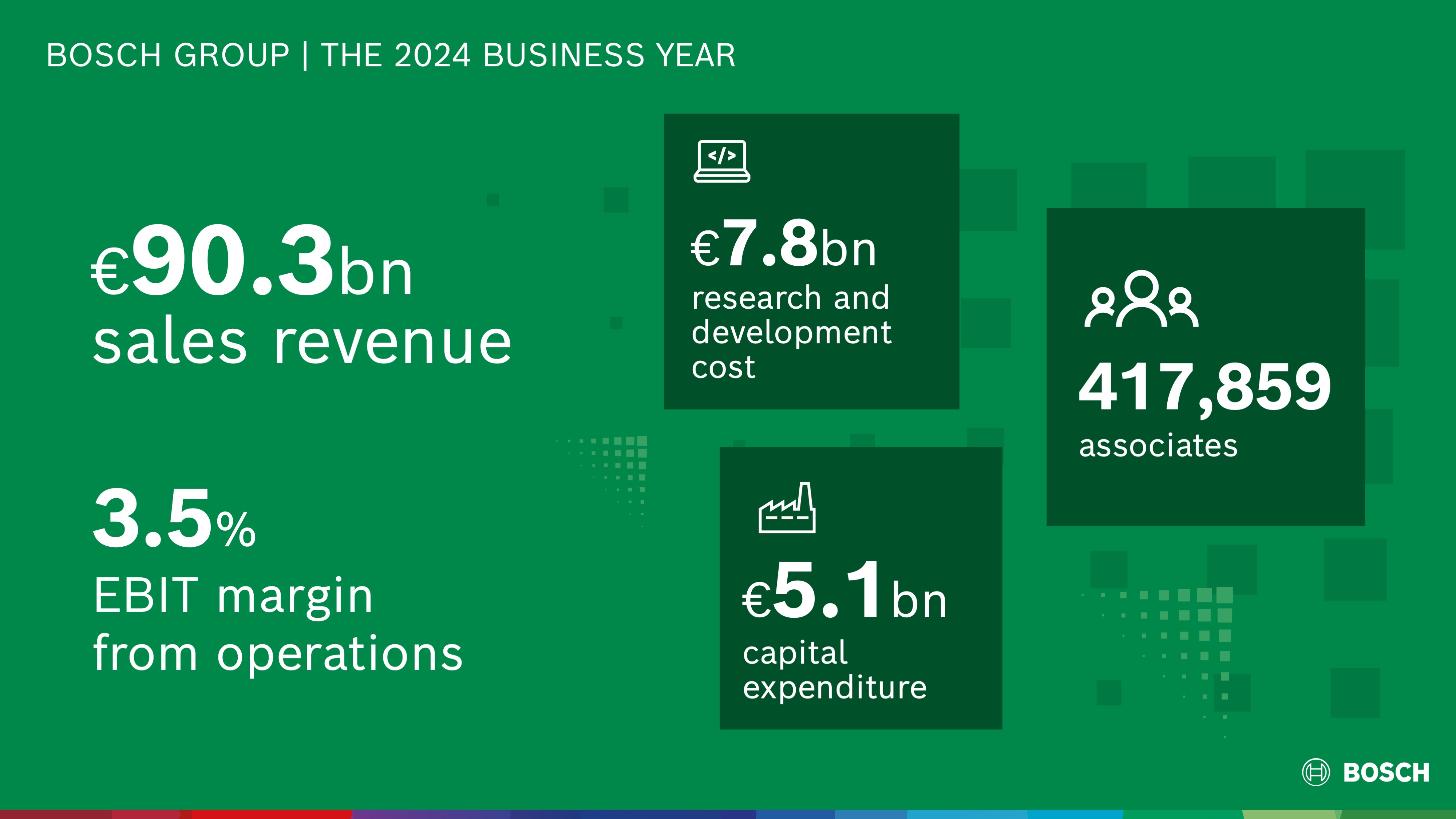

For 2024, Bosch generated a positive free cash flow of 0.9 billion euros (2023: 2.2 billion euros) and thus achieved its target of 1 percent of sales revenue despite lower EBIT. “The Bosch Group’s conservative financial policy ensures financial flexibility and allows us to make large acquisitions and considerable investments,” Forschner said. In the past five years alone, the Bosch Group has invested a total of around 57 billion euros in areas of future importance in order to extend its innovation leadership. Expenditure on research and development amounted to 7.8 billion euros in 2024 (2023: 7.3 billion euros). The R&D ratio remained at a high level of 8.6 percent (2023: 8.0 percent). Capital expenditure fell slightly year on year to 5.1 billion euros (2023: 5.5 billion euros). Liquidity as per the consolidated statement of cash flows stood at 8.2 billion euros (2023: 7.4 billion euros); the equity ratio of 44.3 percent (2023: 44.2 percent) underlines Bosch’s financial robustness.

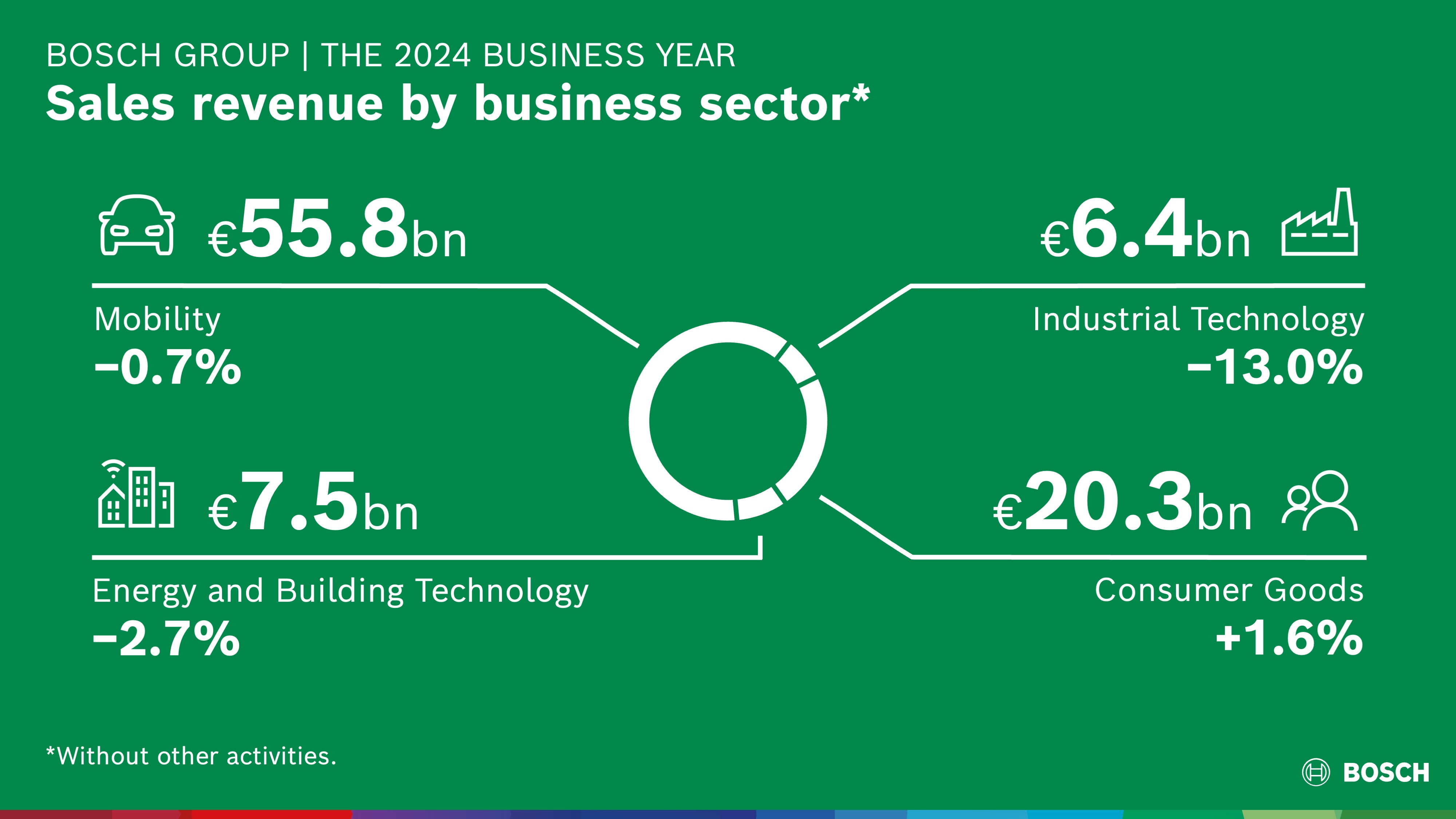

The 2024 business year: development by business sector

All business sectors felt the effects of weak developments in their core markets. In light of the global decline in vehicle production, sales revenue in the Mobility business sector was 55.8 billion euros, and thus 0.7 percent below the previous year – however, adjusted for exchange-rate effects, sales revenue grew 0.2 percent. The EBIT margin from operations was 3.8 percent (2023: 4.4 percent). The Industrial Technology business sector achieved sales of 6.4 billion euros. This represents a decrease of 13.0 percent, or 12.5 percent after adjusting for exchange-rate effects. A key role in this was played by the steeper than expected decline in the construction and machinery sectors in the main markets of Europe, North America, and China. The EBIT margin came to 1.2 percent (2023: 9.1 percent). The Consumer Goods business sector increased its sales revenue by 1.6 percent to 20.3 billion euros, which corresponds to growth of 2.9 percent after adjusting for exchange-rate effects. The EBIT margin was 3.5 percent (2023: 4.5 percent). In the Energy and Building Technology business sector, sales revenue fell by 2.7 percent year on year to 7.5 billion euros. After adjusting for exchange-rate effects, this was equivalent to a fall of 2.6 percent. The main reason for this was the market slump in the European heating business. The EBIT margin was 4.9 percent (2023: 9.0 percent).

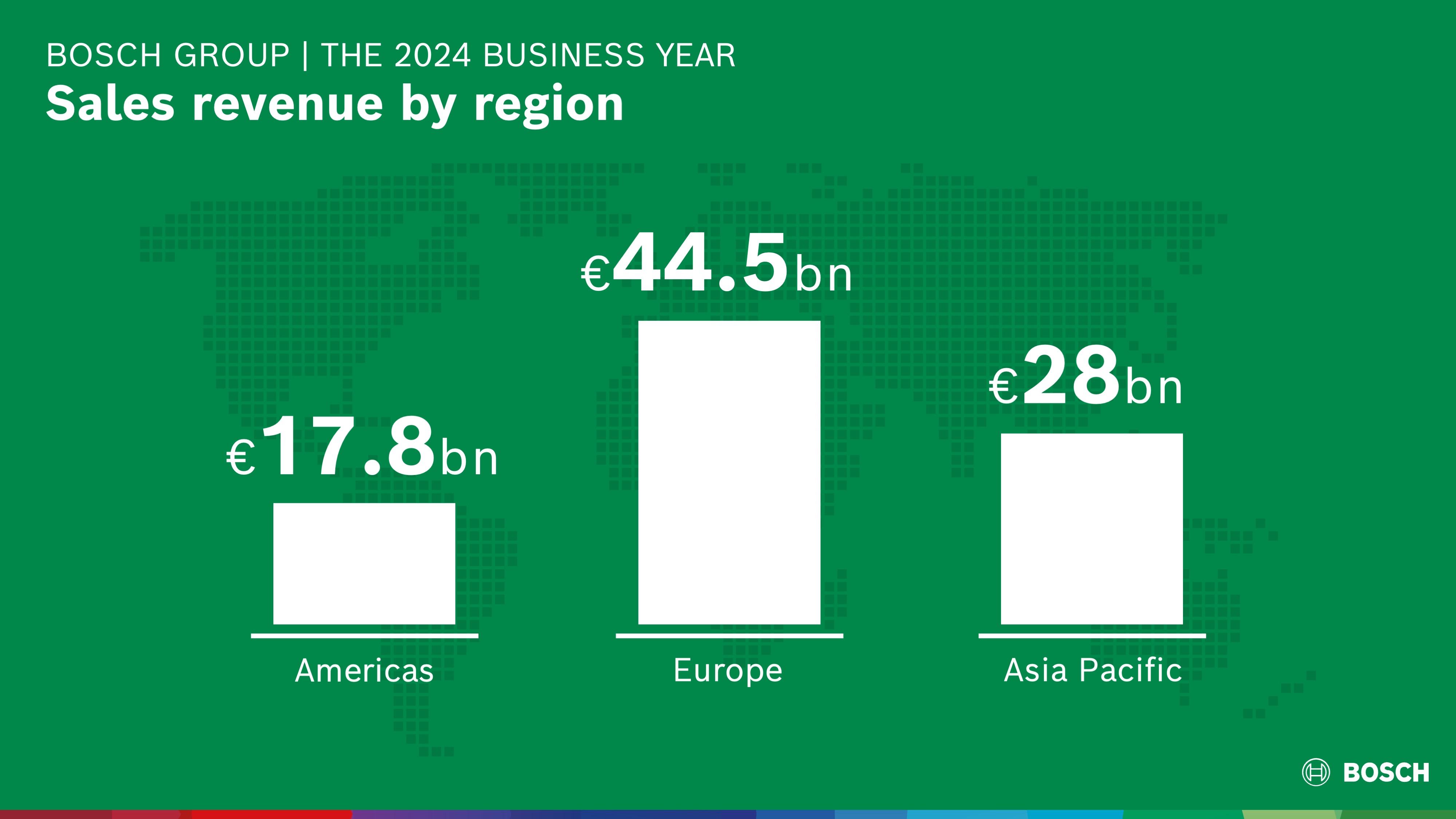

The 2024 business year: development by region

Bosch felt the weakness of its core markets most acutely in Europe. While sales revenue in this region declined by 4.9 percent (4.6 percent after adjusting for exchange-rate effects) to 44.5 billion euros, the company recorded growth in the other regions of the world: in the Americas by 4.8 percent (5.7 percent after adjusting for exchange-rate effects) to 17.8 billion euros, and in Asia Pacific by 0.7 percent (2.8 percent after adjusting for exchange-rate effects) to 28.0 billion euros.

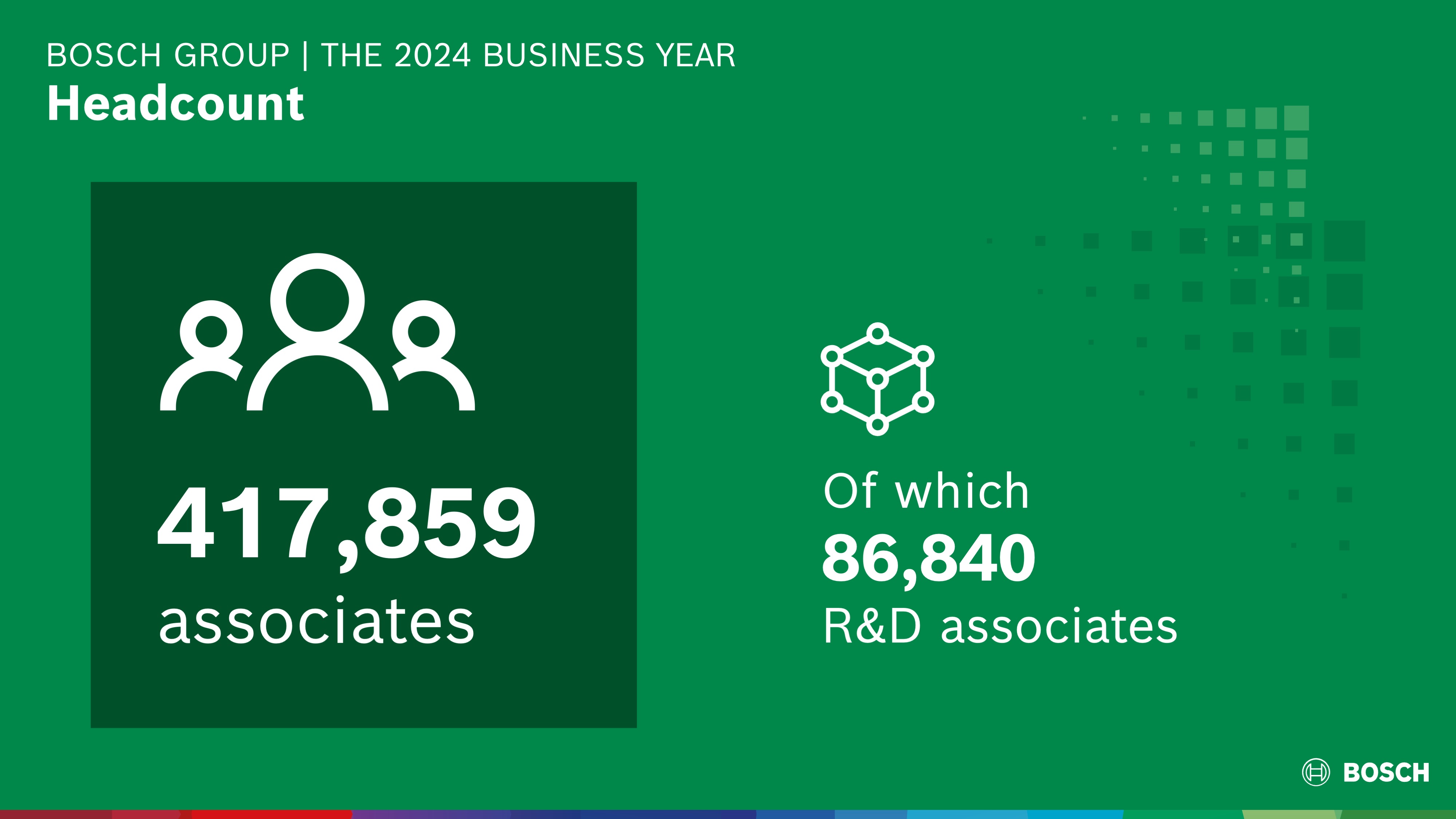

The 2024 business year: development of headcount

The Bosch Group employed 417,859 people worldwide at year-end 2024 (2023: 429,416). The overall headcount fell by 2.7 percent, bringing it 11,557 below the previous year’s figure.