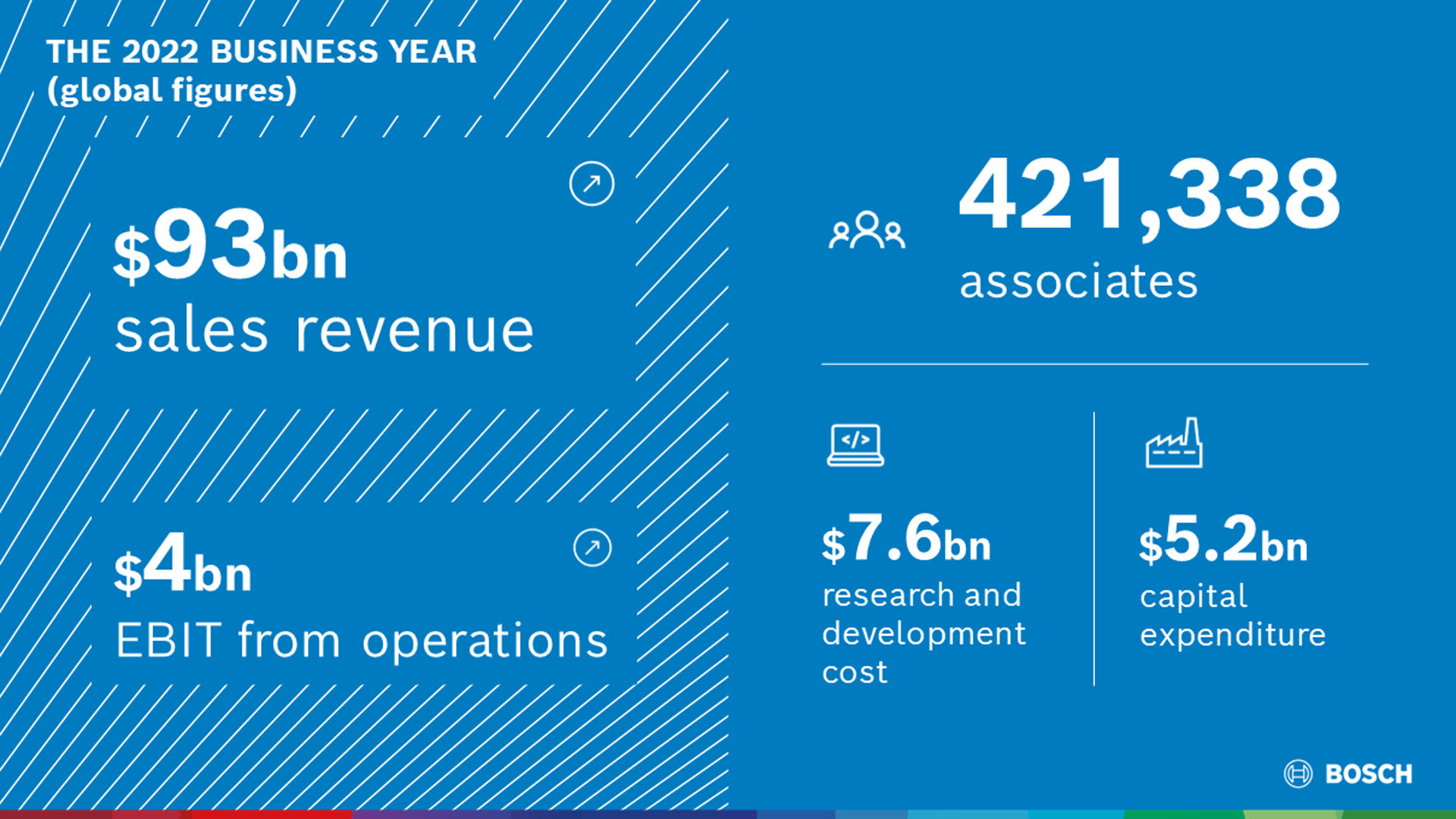

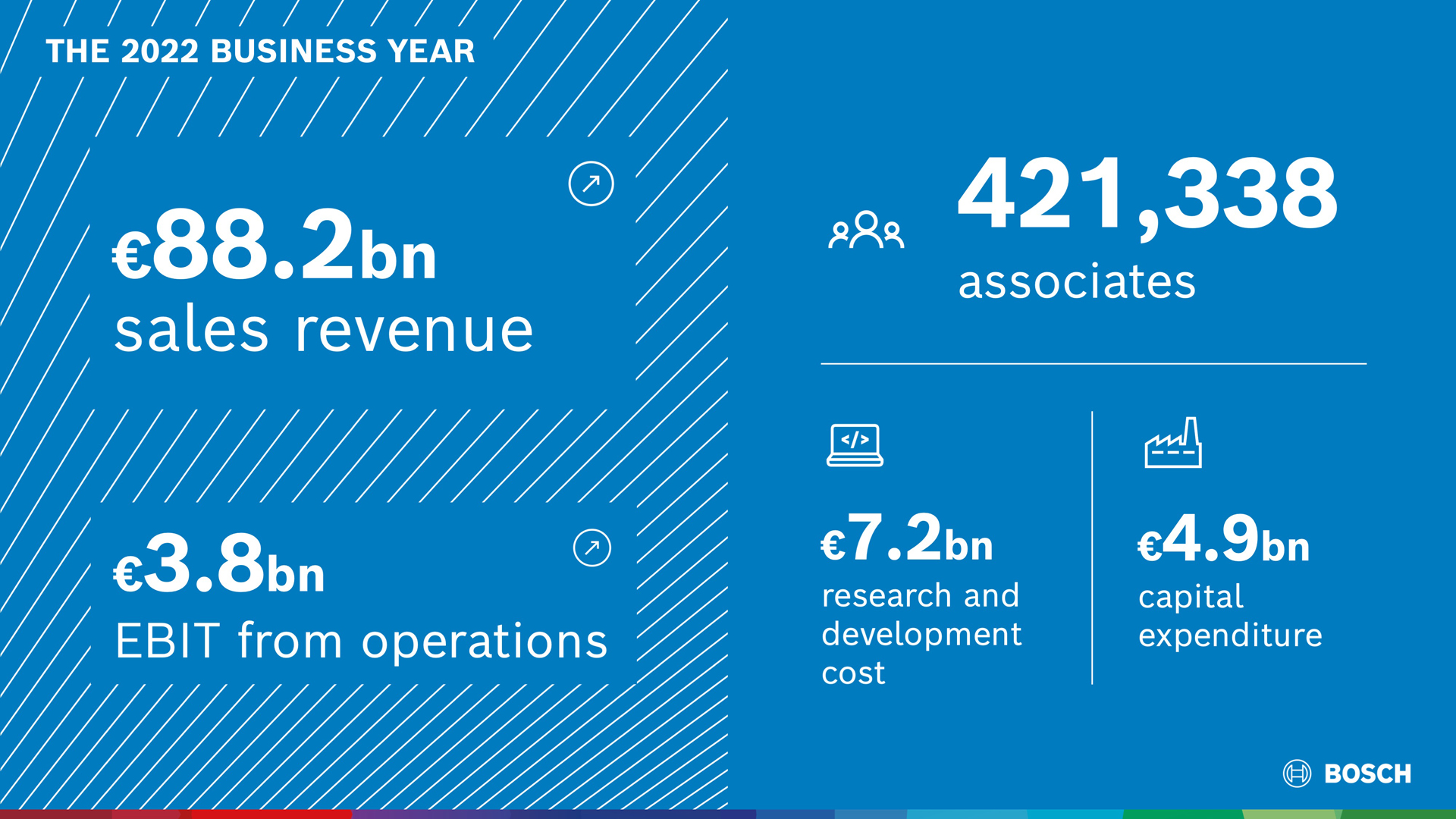

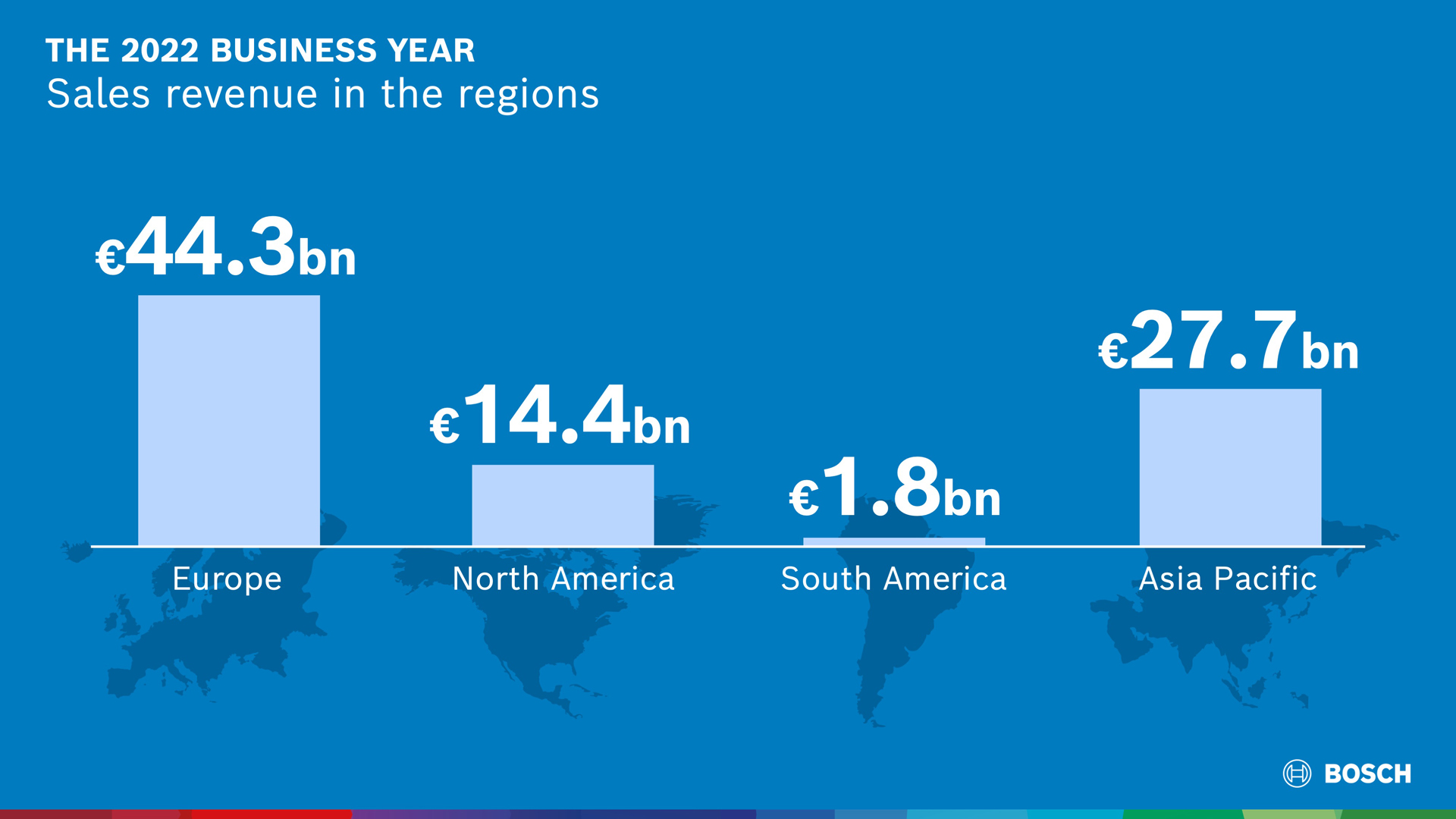

Stuttgart and Renningen, Germany – In 2022, Bosch exceeded its business targets in what was a challenging year. The supplier of technology and services increased its total sales to $93 billion, following $83 billion the previous year. This is an increase of 12.0 percent, or an exchange rate-adjusted 9.4 percent. At $4 billion, EBIT (earnings before interest and taxes) from operations is also higher than the previous-year figure of $3.4 billion. The EBIT margin from operations rose from 4.0 to 4.3 percent. Presenting the company’s annual figures, Dr. Stefan Hartung, the chairman of the board of management of Robert Bosch GmbH, said: “We rose well to the challenges of 2022 – both our sales and our margin were higher than expected. And even if the economic and social environment remains demanding, we want to grow significantly faster.”

In the years ahead, given normal rates of inflation, the aim is for annual sales to grow by 6 to 8 percent on average, and for margin to reach at least 7 percent. “Our aim is to grow in every region of the world and to be among the leading three suppliers in our relevant markets,” Hartung said.

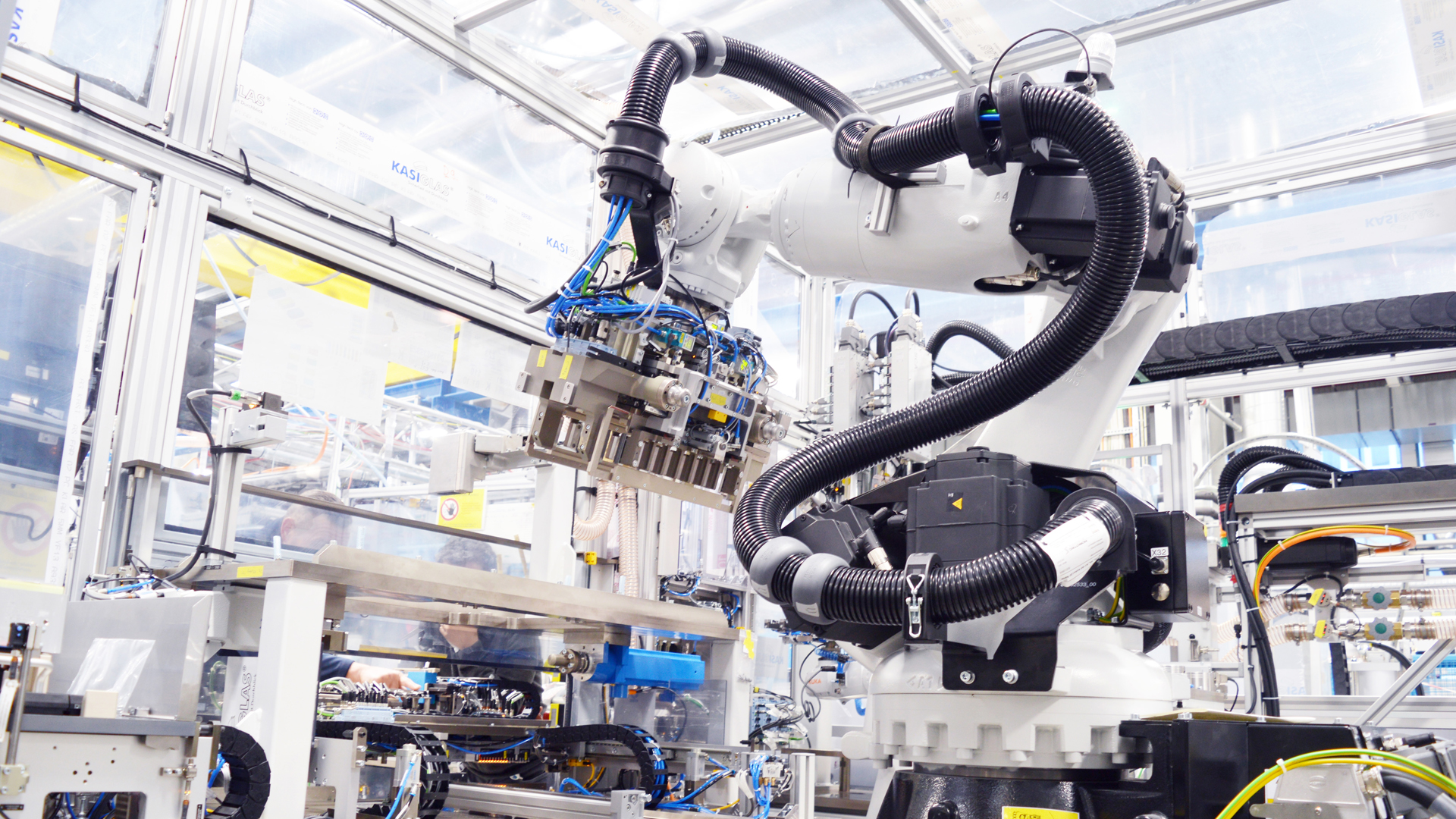

The fight against climate change is causing considerable upheaval in business and society, and also accelerating technological change. “This technological transformation is opening up growth opportunities that we want to seize, both in our existing business and in related and new areas,” Hartung said. “In this context, our ‘Invented for life’ ethos is ideal – not only when it comes to the major trends of electrification, automation, and digitalization, but more than ever also with respect to software and artificial intelligence.”

Contact persons for press inquiries:

Tim Wieland, Bosch

Phone: +1 248-876-7708

Tim.Wieland@us.bosch.com

About Bosch

Having established a regional presence in 1906 in North America, the Bosch Group employs nearly 35,500 associates in more than 100 locations, as of December 31, 2021. In 2021, Bosch generated consolidated sales of $13.5 billion in the U.S., Canada and Mexico. For more information, visit www.bosch.us, www.bosch.ca and www.bosch.mx.

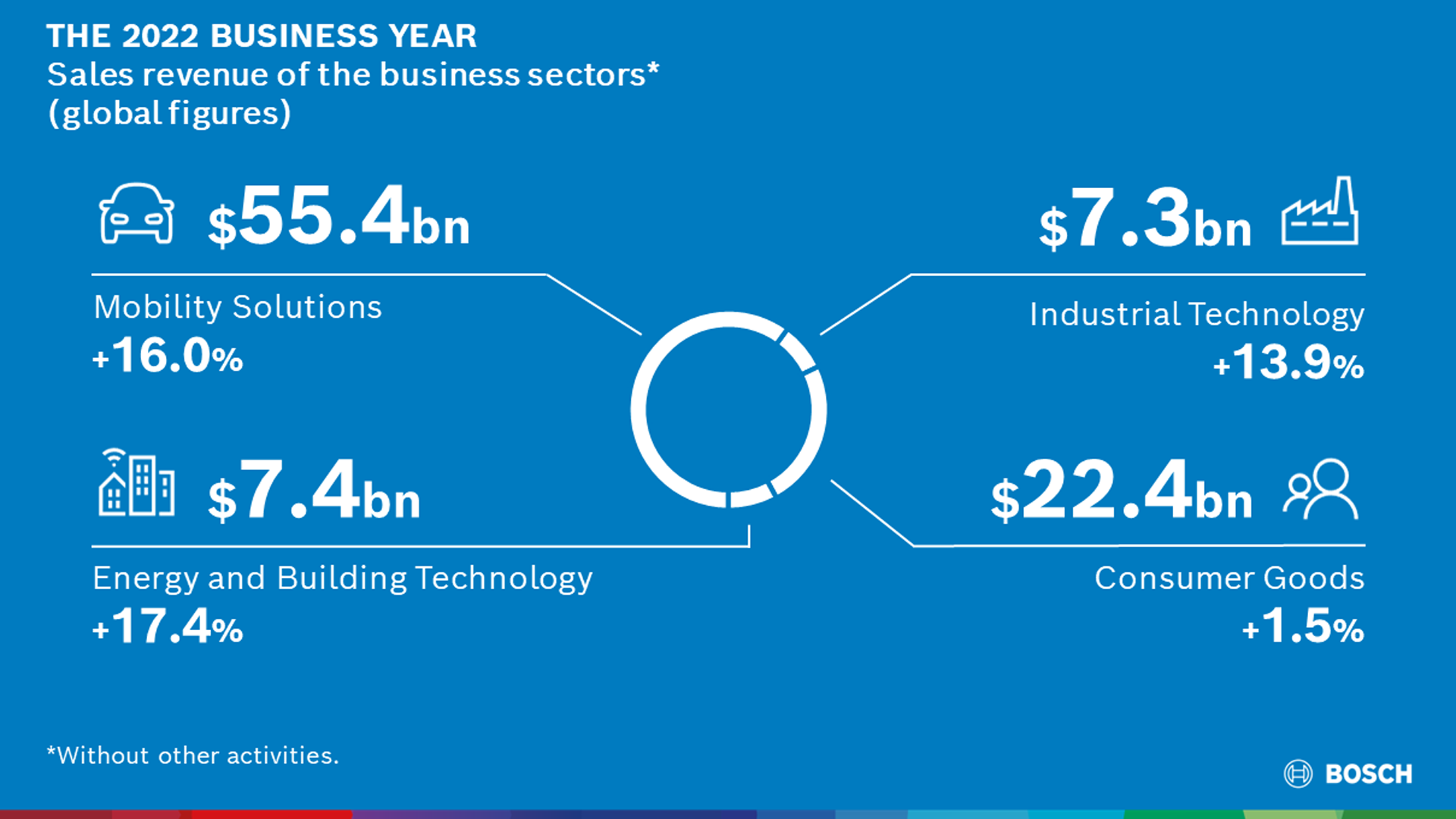

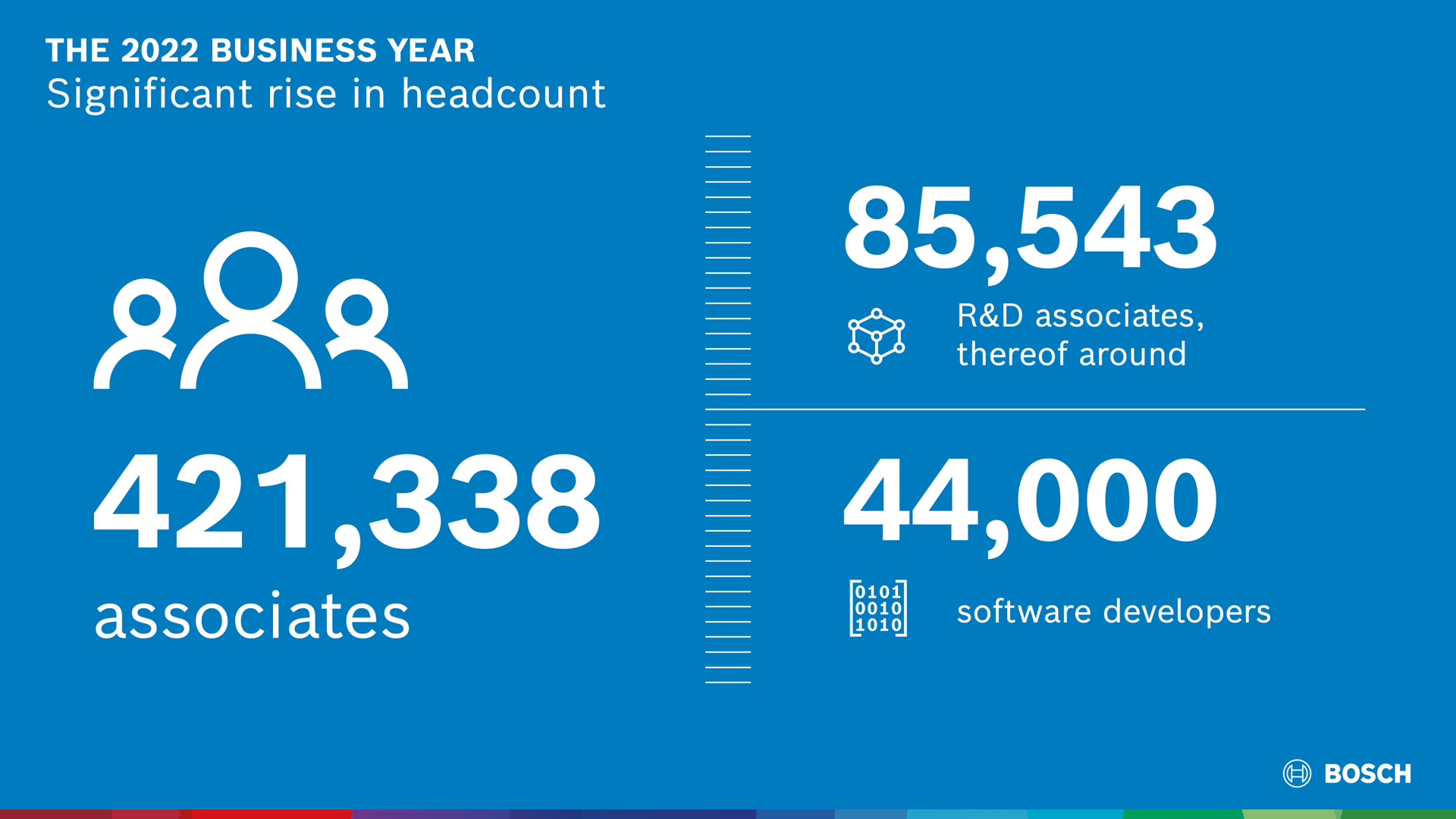

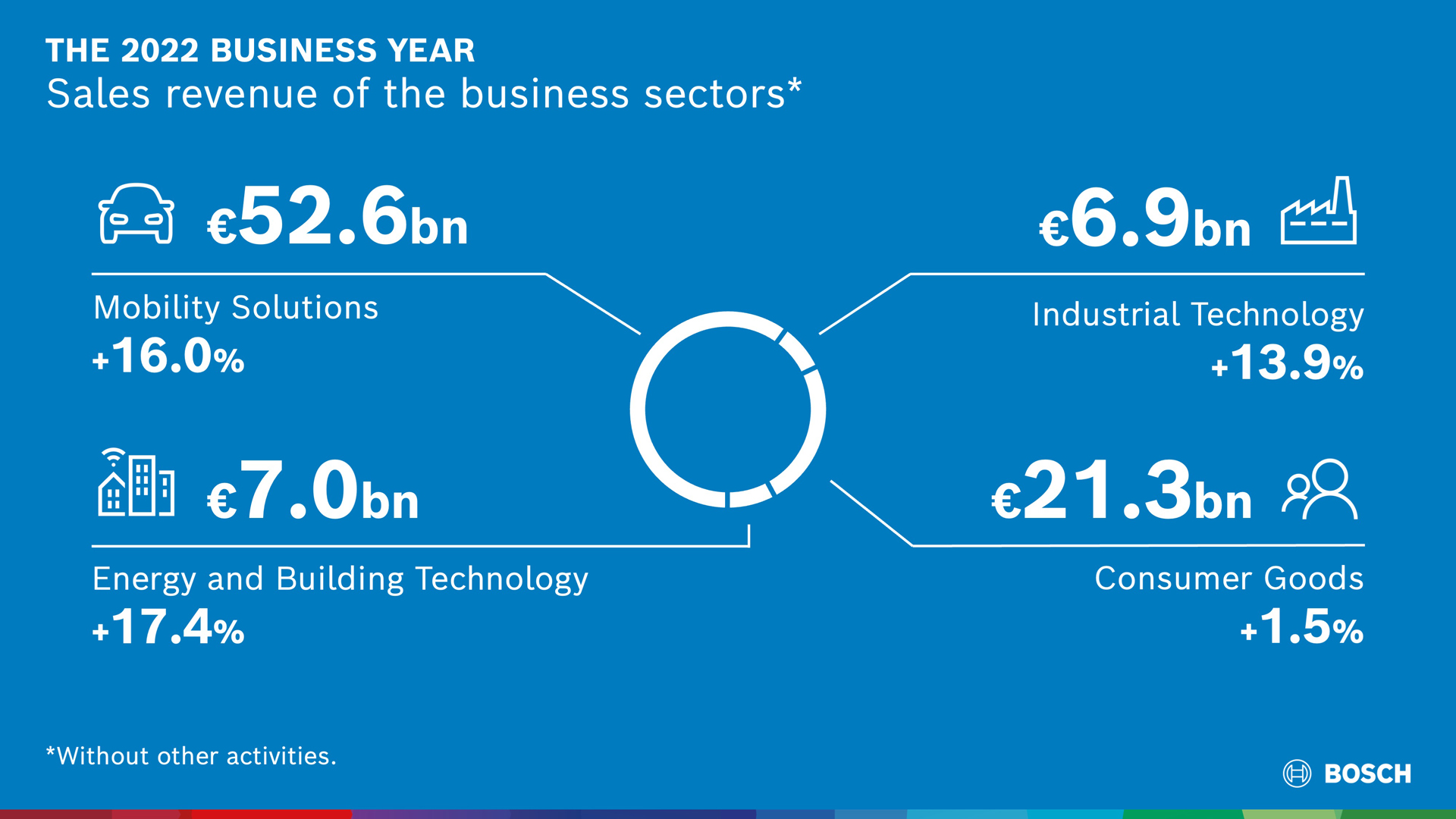

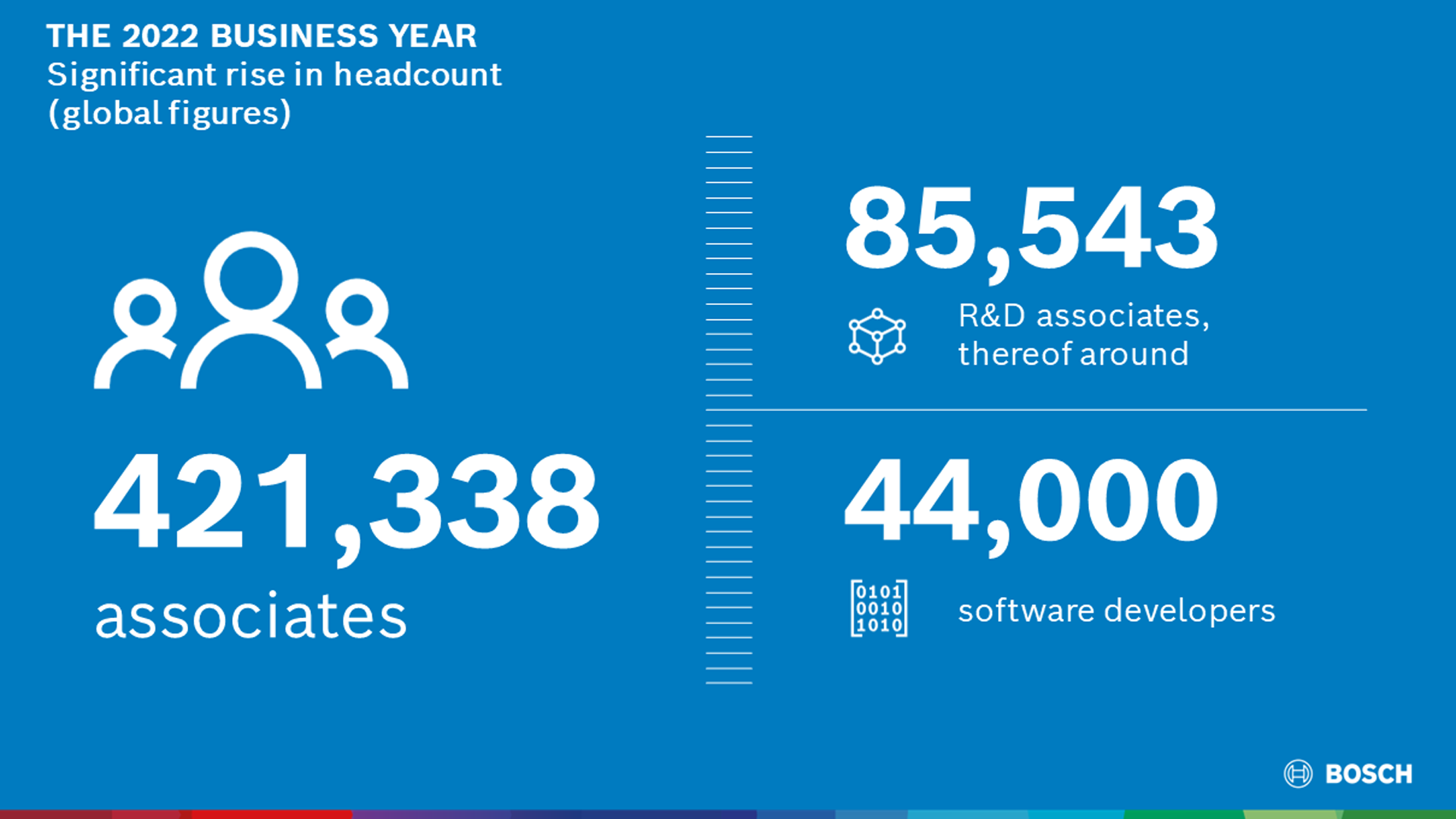

The Bosch Group is a leading global supplier of technology and services. It employs roughly 421,000 associates worldwide (as of December 31, 2022). The company generated sales of $93 billion in 2022. Its operations are divided into four business sectors: Mobility Solutions, Industrial Technology, Consumer Goods, and Energy and Building Technology. As a leading IoT provider, Bosch offers innovative solutions for smart homes, Industry 4.0, and connected mobility. Bosch is pursuing a vision of mobility that is sustainable, safe, and exciting. It uses its expertise in sensor technology, software, and services, as well as its own IoT cloud, to offer its customers connected, cross-domain solutions from a single source. The Bosch Group’s strategic objective is to facilitate connected living with products and solutions that either contain artificial intelligence (AI) or have been developed or manufactured with its help. Bosch improves quality of life worldwide with products and services that are innovative and spark enthusiasm. In short, Bosch creates technology that is “Invented for life.” The Bosch Group comprises Robert Bosch GmbH and its roughly 470 subsidiary and regional companies in over 60 countries. Including sales and service partners, Bosch’s global manufacturing, engineering, and sales network covers nearly every country in the world. With its more than 400 locations worldwide, the Bosch Group has been carbon neutral since the first quarter of 2020. The basis for the company’s future growth is its innovative strength. At 136 locations across the globe, Bosch employs some 85,500 associates in research and development, of which nearly 44,000 are software engineers

The company was set up in Stuttgart in 1886 by Robert Bosch (1861–1942) as “Workshop for Precision Mechanics and Electrical Engineering.” The special ownership structure of Robert Bosch GmbH guarantees the entrepreneurial freedom of the Bosch Group, making it possible for the company to plan over the long term and to undertake significant upfront investments in the safeguarding of its future. Ninety-four percent of the share capital of Robert Bosch GmbH is held by Robert Bosch Stiftung GmbH, a charitable foundation. The remaining shares are held by Robert Bosch GmbH and by a corporation owned by the Bosch family. The majority of voting rights are held by Robert Bosch Industrietreuhand KG, an industrial trust. The entrepreneurial ownership functions are carried out by the trust.

Additional information is available online at www.bosch.com, www.iot.bosch.com, www.bosch-press.com, www.twitter.com/BoschPresse.

Exchange rate: 1 EUR = 1.0538