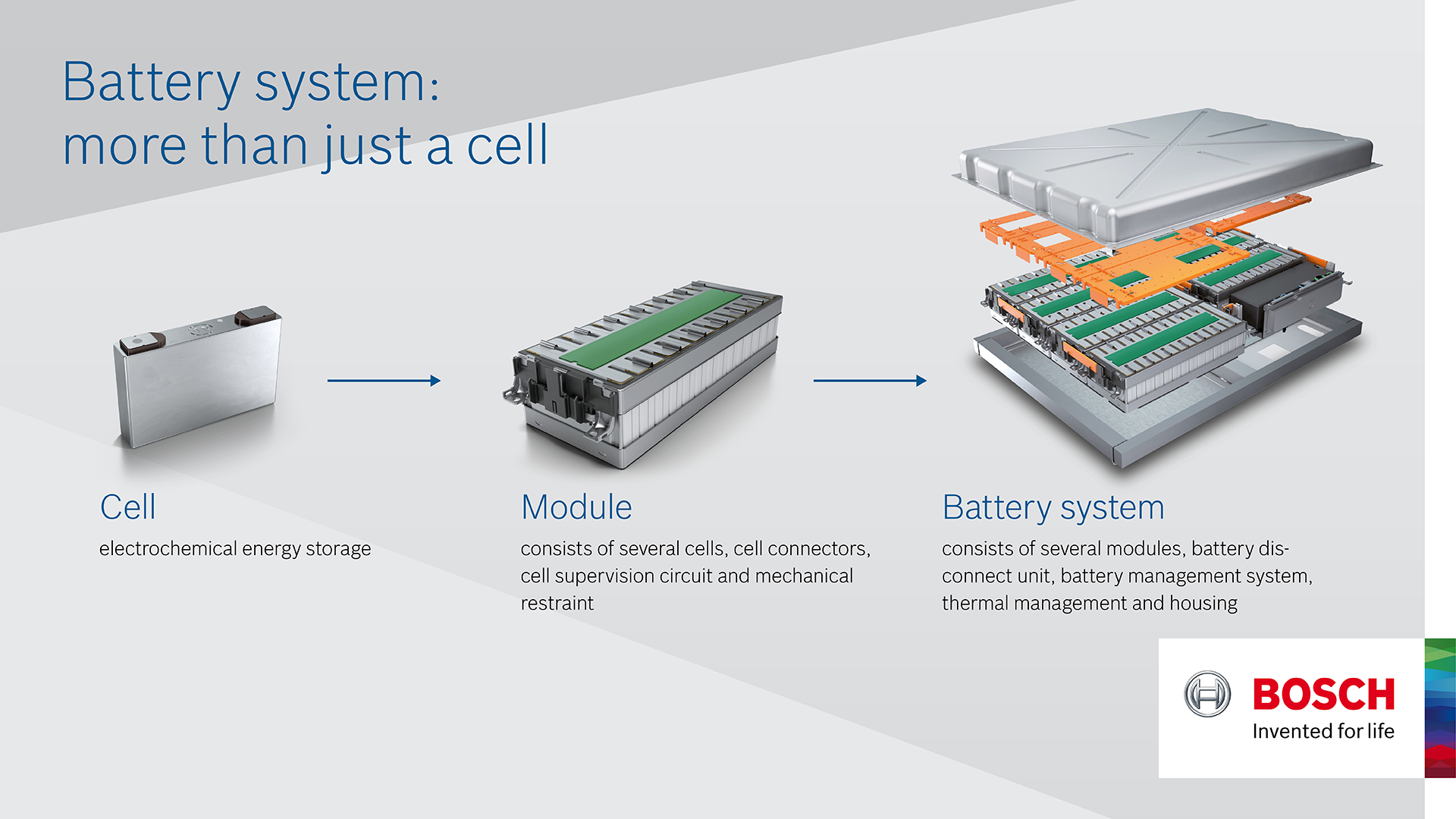

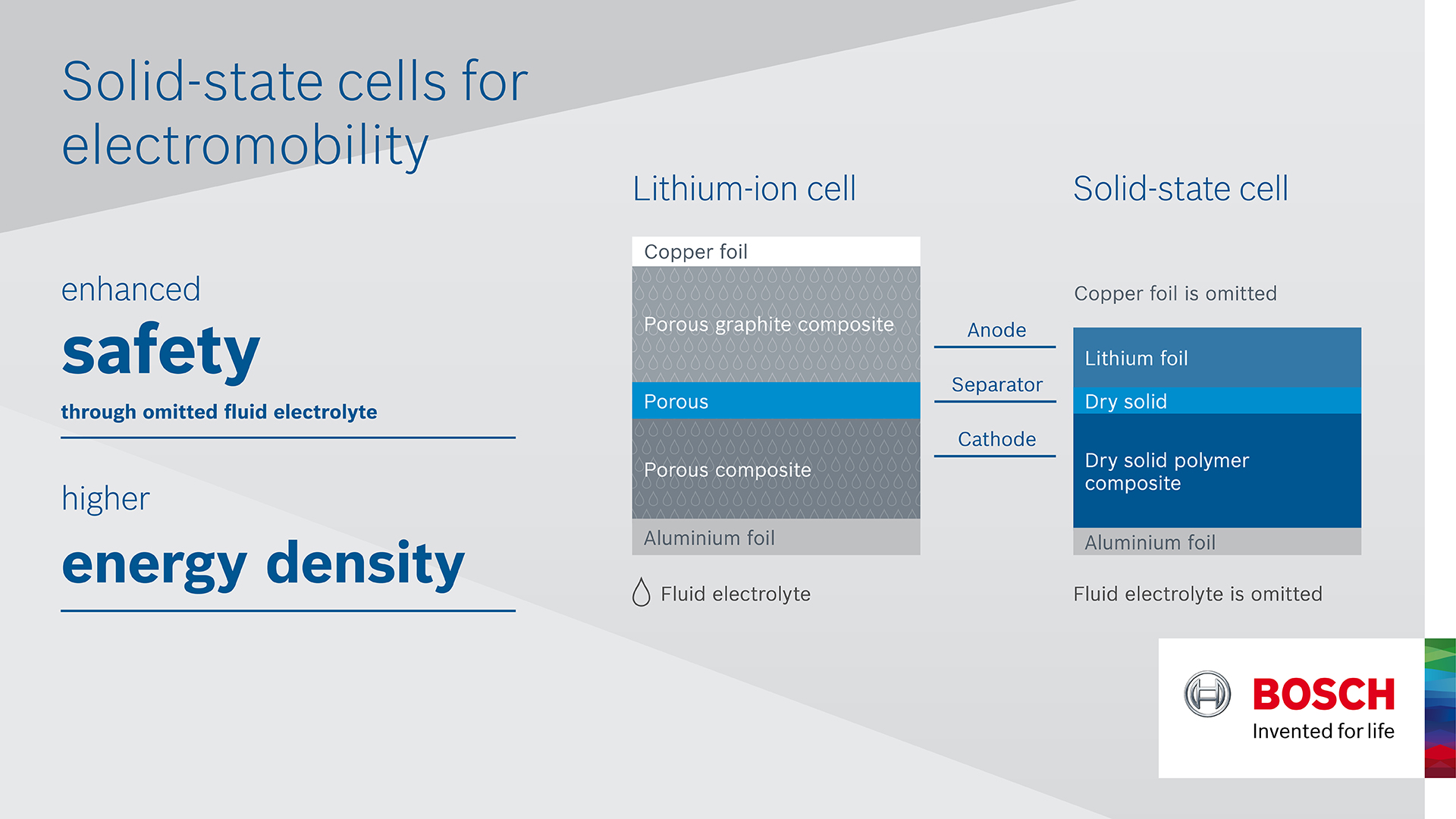

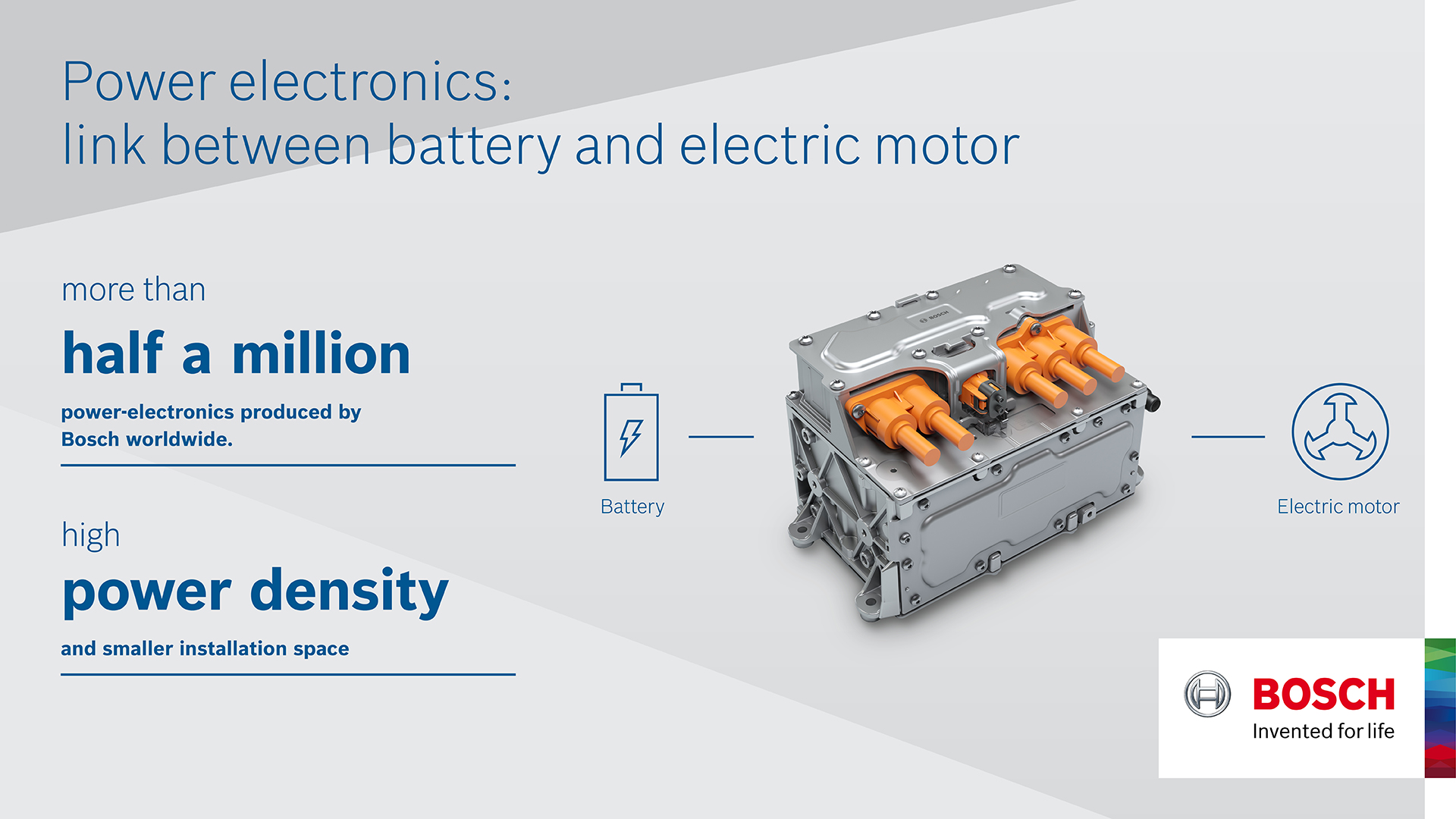

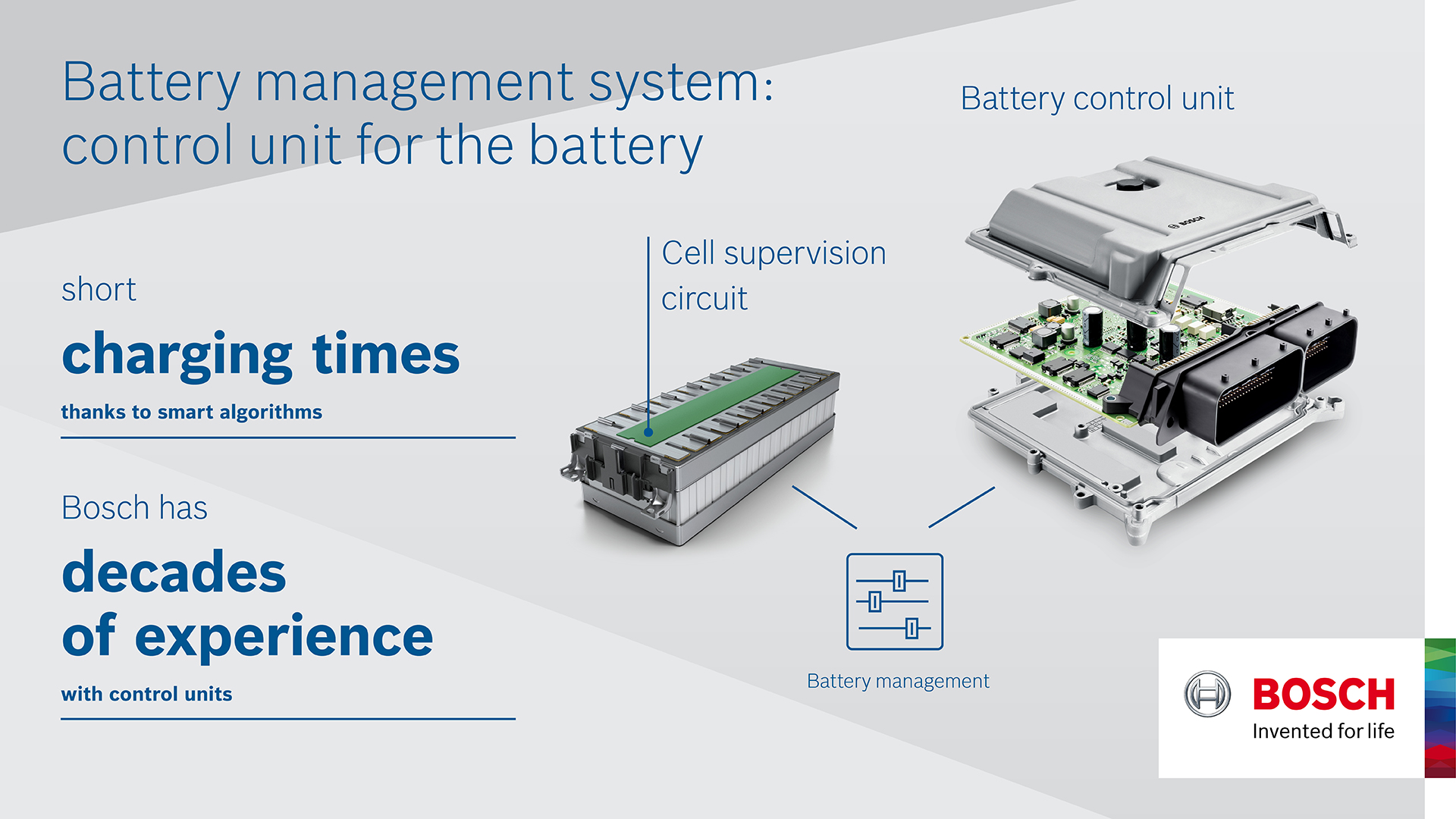

Stuttgart, Germany – Bosch aims to lead the mass market for electromobility that will emerge after 2020. In this endeavor, it is relying on its systems expertise and the development and manufacture of key components of the electrical powertrain, such as the electric motor, power electronics, and battery systems. The company will continue to buy in the cells needed to make these battery systems. For economic reasons, Bosch has decided not to set up cell manufacturing operations of its own. “For Bosch, it’s important to have a technical understanding of cells. We don’t have to make them ourselves,” says Dr. Rolf Bulander, member of the board of management of Robert Bosch GmbH and chairman of the Mobility Solutions business sector.

Mobility is the largest Bosch Group business sector. In 2023, its sales came to 56.2 billion euros, or just under 60 percent of total Group sales. This makes the Bosch Group one of the leading mobility suppliers. Bosch Mobility pursues a vision of mobility that is safe, sustainable, and exciting. For its customers, the outcome is integrated mobility solutions. The business sector’s main areas of activity are electrification, software and services, semiconductors and sensors, vehicle computers, advanced driver assistance systems, systems for vehicle dynamics control, repair-shop concepts, as well as technology and services for the automotive aftermarket. Bosch is synonymous with important automotive innovations, such as electronic engine management, the ESP anti-skid system, and common-rail diesel technology.

The Bosch Group is a leading global supplier of technology and services. It employs roughly 429,000 associates worldwide (as of December 31, 2023). The company generated sales of 91.6 billion euros in 2023. Its operations are divided into four business sectors: Mobility, Industrial Technology, Consumer Goods, and Energy and Building Technology. With its business activities, the company aims to use technology to help shape universal trends such as automation, electrification, digitalization, connectivity, and an orientation to sustainability. In this context, Bosch’s broad diversification across regions and industries strengthens its innovativeness and robustness. Bosch uses its proven expertise in sensor technology, software, and services to offer customers cross-domain solutions from a single source. It also applies its expertise in connectivity and artificial intelligence in order to develop and manufacture user-friendly, sustainable products. With technology that is “Invented for life,” Bosch wants to help improve quality of life and conserve natural resources. The Bosch Group comprises Robert Bosch GmbH and its roughly 470 subsidiary and regional companies in over 60 countries. Including sales and service partners, Bosch’s global manufacturing, engineering, and sales network covers nearly every country in the world. Bosch’s innovative strength is key to the company’s further development. At 136 locations across the globe, Bosch employs some 90,000 associates in research and development, of which nearly 48,000 are software engineers.

Additional information is available online at www.bosch.com, www.iot.bosch.com, www.bosch-press.com.